Alpha Capital Group Inside Review in 2025: A Complete Trader’s Guide

The Pros & Cons of Alpha Capital Group

Pros+

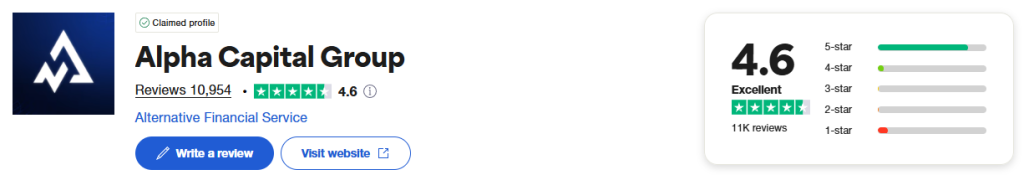

- Excellent Trustpilot Rating of 4.5/5

- Four Unique Funding Programs

- Free Trial

- Professional Trader Dashboard

- Leverage up to 1:100

- Zero Commission Fees

- No Minimum Trading Day Requirements on Alpha One-step Challenge

- No Maximum Trading Period

- Scaling Plan

- Bi-weekly Payouts on Alpha Pro & Alpha Swing Challenges

- On-demand Payouts on Alpha One-step Challenge

- Profit Share of 80%

- Overnight Holding Allowed

- Weekend Holding Allowed (Except on Alpha Pro Challenge Once Funded)

- News Trading Allowed (Except on Alpha Pro & Alpha One-step Challenge Once Funded)

- Balance-based Drawdown

Cons–

- Minimum Trading Day Requirements of 3 Days on Alpha Pro & Alpha Swing Challenges

- Lot Size Limit (Once Funded)

- Minimum Average Trade Duration of 2 Minutes

Alpha Capital Group offers traders a comprehensive platform featuring educational videos, market insights, mentoring, trading strategies, and custom-built technology. This support system aims to guide traders toward obtaining funding and eventually becoming proprietary traders within the group. Traders have the opportunity to earn substantial profits, with the flexibility to manage account sizes up to $200,000 and receive 80% profit splits. This can be accomplished through trading various financial instruments, including forex pairs, commodities, and indices.

Who are Alpha Capital Group?

Alpha Capital Group is a proprietary trading firm with the legal name Alpha Capital Group Limited that was incorporated on the 2nd of November, 2021. They are located in London, UK, and are being managed by CEO George Kohler. Alpha Capital Group provide traders with the opportunity to choose between four account types, two two-step evaluations, a one-step evaluation, and a three-step evaluation while developing their own ACG Markets brokerage.

Their headquarters are located at 10 Lower Thames Street, Billingsgate, London, England, EC3R 6AF.

Funding Program Options

Alpha Capital Group provides its traders with four unique funding program options:

- Alpha Pro Challenge

- Alpha Swing Challenge

- Alpha One-step Challenge

- Alpha Three-step Challenge

What Makes Alpha Capital Group Different From Other Prop Firms?

Alpha Capital Group differs from most industry-leading prop firms due to offering four unique account types: two two-step evaluations, a one-step evaluation, and a three-step evaluation. In addition, they also provide numerous favorable features, such as an unlimited trading period, no minimum trading day requirements (on Alpha One-step Evaluation), no commission fees, first withdrawal after only 14 calendar days, and bi-weekly future payouts.

Alpha Capital Group’s Alpha Pro Challenge is a two-step evaluation that requires traders to successfully complete two phases before becoming eligible for payouts. The profit target is 8% in phase one and 5% in phase two, with a 5% maximum daily and 10% maximum loss rules. You also have no maximum trading day requirements during either evaluation phase. However, you are required to trade for a minimum of 3 calendar days in each evaluation phase. The Alpha Pro Challenge also has a unique scaling plan, allowing traders to manage even larger account sizes. Compared to other funding programs within the industry, the Alpha Pro Challenge stands out mainly for having an unlimited trading period, no commission fees, first withdrawal after only 14 calendar days, and bi-weekly future payouts.

Trustpilot Feedback

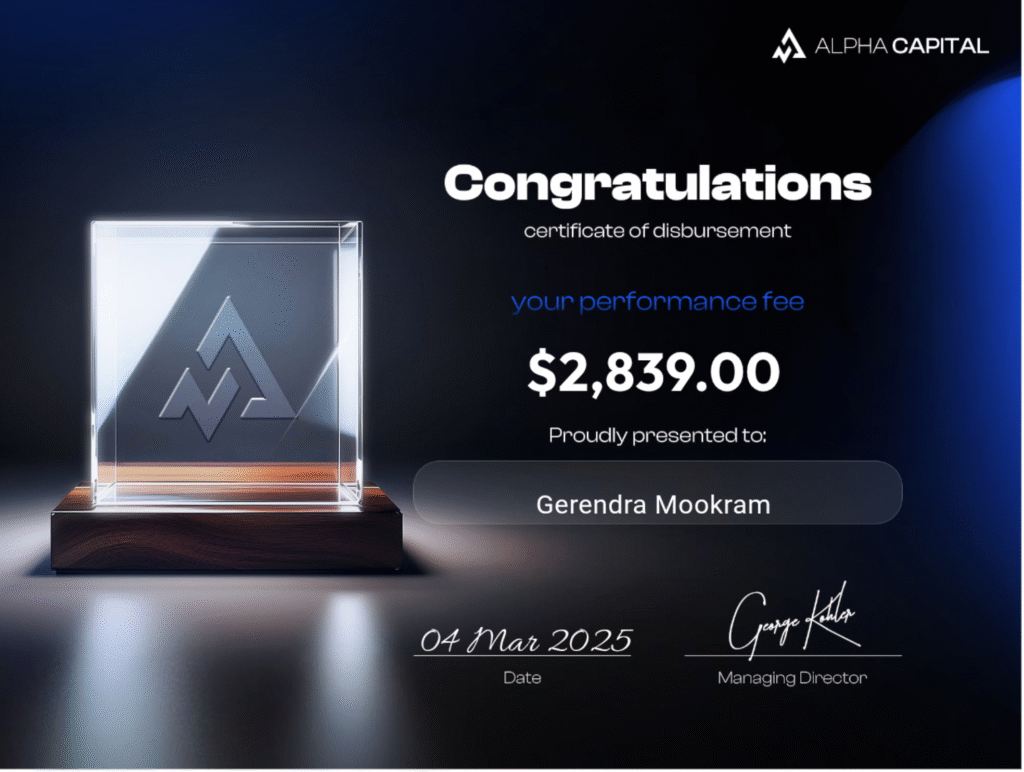

Payment Proof

Alpha Capital Group is a proprietary trading firm that was incorporated on the 2nd of November, 2021. They have a large community of traders who have reached funded status and successfully qualify for a profit split.

While working with Alpha Capital Group and reaching funded status with the Alpha Pro Challenge, Alpha Swing Challenge, or Alpha Three-step Challenge you will be eligible to receive your first payout after 14 calendar days or on-demand. On-demand payouts require at least 2% of total gross profits in your account balance and compliance with the 40% Best Day Rule, which means no single trading day can contribute more than 40% of your total profits. Bi-weekly payouts are available every two weeks, with a minimum withdrawal of $100 and at least 5 trading days completed within the period. Your profit split will consist of a generous 80% based on the profit that you have generated on your funded account.

However, while working with Alpha Capital Group and reaching funded status with the Alpha One-step Challenge, you will be eligible to receive your first payout on-demand with a minimum consistency score of 50% and a minimum profit of 2%. However, after your first payout, you will also be eligible to receive payouts on an on-demand basis if the above requirements are met. Your profit split will consist of a generous 80% based on the profit that you have generated on your funded account.

When it comes to Alpha Capital Group payment proof, you can find it on numerous websites. One example is Trustpilot, where their traders comment regarding their experience while working with the company as well as the process of how they successfully received payouts. Another source of payment proof for Alpha Capital Group is their Discord channel and YouTube channel, where you can find numerous payout certificates and interviews of the most successful traders.

Examples of Payout Certificates and Payment Proof can be seen in the images below.

Which Broker Does Alpha Capital Group Use?

Alpha Capital Group doesn’t trade with any of the common broker brands. Instead, they have developed their own ACG Markets broker.

Conclusion

In conclusion, Alpha Capital Group is a reputable and trustworthy proprietary trading firm providing traders with an opportunity to choose between Four funding programs: Alpha Pro Challenge and Alpha Swing Challenge, which are both two-step programs, Alpha One-step Challenge, which is a one-step program, and Alpha Three-step Challenge, which is a three-step program.

Alpha Capital Group’s Alpha Pro Challenge is an industry-standard two-step evaluation that requires the completion of two phases before becoming eligible to manage a funded account and earn 80% profit splits. Traders must reach profit targets of 8% in phase one and 5% in phase two to become successfully funded. These are realistic trading objectives, considering you have a 5% maximum daily and 10% maximum loss rules to follow. Regarding time limitations, you have no maximum trading day requirements during either evaluation phase. However, you are required to trade for a minimum of 3 calendar days in each evaluation phase. Finally, it’s essential to note that the Alpha Pro Challenge features a scaling plan, providing you with the opportunity to increase your initial account balance.

Alpha Capital Group’s Alpha Swing Challenge is an industry-standard two-step evaluation that requires the completion of two phases before becoming eligible to manage a funded account and earn 80% profit splits. Traders must reach profit targets of 10% in phase one and 5% in phase two to become successfully funded. These are realistic trading objectives, considering you have a 5% maximum daily and 10% maximum loss rules to follow. Regarding time limitations, you have no maximum trading day requirements during either evaluation phase. However, you are required to trade for a minimum of 3 calendar days in each evaluation phase. Finally, it’s essential to note that the Alpha Swing Challenge features a scaling plan, providing you with the opportunity to increase your initial account balance.

Alpha Capital Group’s Alpha One-step Challenge is a one-step evaluation that requires the completion of a single phase before becoming eligible to manage a funded account and earn 80% profit splits. Traders must reach a profit target of 10% to become successfully funded. These are realistic trading objectives, considering you have a 4% maximum daily and 6% maximum loss rules to follow. Regarding time limitations, you have no minimum or maximum trading day requirements during the evaluation phase, meaning that you can trade based on your preferred pace without any time pressure. Finally, it’s essential to note that the Alpha One-step Challenge features a scaling plan, providing you with the opportunity to increase your initial account balance.

Alpha Capital Group’s Alpha Three-step Challenge is an industry-standard three-step evaluation that requires the completion of three phases before becoming eligible to manage a funded account and earn 80% profit splits. Traders must reach profit targets of 8% in phase one, 4% in phase two and 4% in phase three to become successfully funded. These are realistic trading objectives, considering you have a 4% maximum daily and 6% maximum loss rules to follow. Regarding time limitations, you have no maximum trading day requirements during either evaluation phase. However, you are required to trade for a minimum of 3 calendar days in each evaluation phase. Finally, it’s essential to note that the Alpha Three-step Challenge features a scaling plan, providing you with the opportunity to increase your initial account balance.

I would recommend Alpha Capital Group to individuals seeking a reputable proprietary trading firm that provides exceptional trading conditions catering to a diverse range of individuals with unique trading styles. They provide traders with unique features, such as an unlimited trading period, no minimum trading day requirements (on Alpha One-step Evaluation), no commission fees, first withdrawal after only 14 calendar days, and bi-weekly future payouts. After considering everything Alpha Capital Group has to offer to traders all across the globe, they can undoubtedly be regarded as one of the industry-leading prop firms.